Revolutionizing Quantum Computing: How Cryogenic Engineering Will Shape the Industry in 2025 and Beyond. Explore the Critical Technologies, Market Growth, and Strategic Opportunities Driving the Next Era of Quantum Systems.

- Executive Summary: Cryogenic Engineering’s Role in Quantum Computing (2025–2030)

- Market Size, Growth Forecasts, and Key Drivers (2025–2030)

- Core Cryogenic Technologies: Dilution Refrigerators, Pulse Tubes, and Helium Systems

- Major Players and Strategic Partnerships (e.g., Bluefors, Oxford Instruments, Quantum Machines)

- Emerging Materials and Advanced Cooling Techniques

- Integration Challenges: Scalability, Reliability, and Cost Reduction

- Regulatory Standards and Industry Initiatives (e.g., IEEE, ASME)

- Regional Analysis: North America, Europe, Asia-Pacific Trends

- Investment Landscape and Funding Outlook

- Future Outlook: Disruptive Innovations and Market Opportunities Through 2030

- Sources & References

Executive Summary: Cryogenic Engineering’s Role in Quantum Computing (2025–2030)

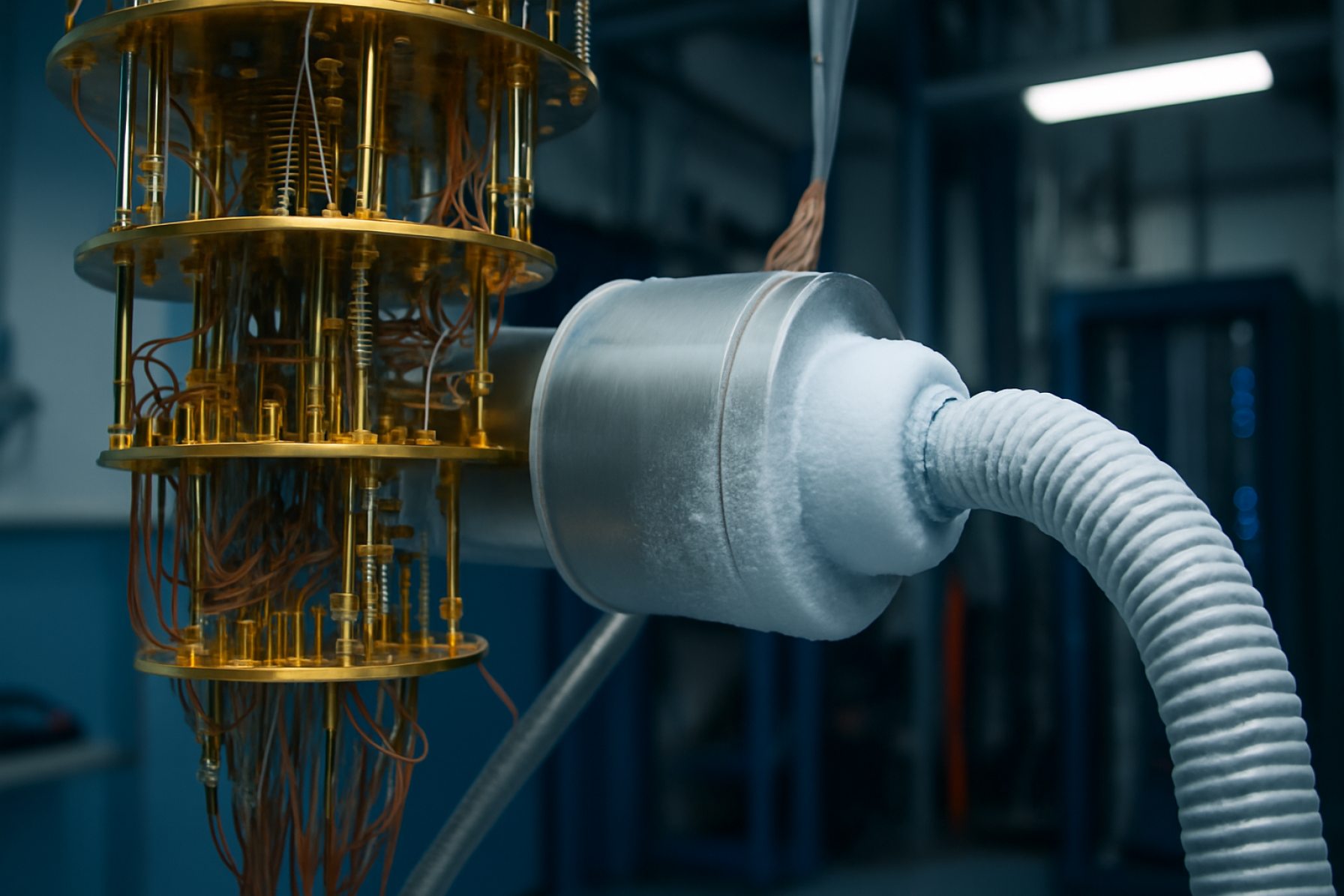

Cryogenic engineering has emerged as a foundational pillar in the advancement of quantum computing systems, particularly as the industry enters a critical growth phase between 2025 and 2030. Quantum processors—especially those based on superconducting qubits and spin qubits—require ultra-low temperatures, often below 20 millikelvin, to maintain quantum coherence and minimize noise. This necessity has driven rapid innovation and investment in cryogenic infrastructure, with specialized dilution refrigerators and cryostats becoming essential components of quantum computing stacks.

Leading quantum hardware developers such as IBM, Bluefors, and Oxford Instruments are at the forefront of integrating advanced cryogenic systems into their quantum platforms. IBM has publicly showcased its “Goldeneye” dilution refrigerator, designed to support quantum processors with thousands of qubits, highlighting the scale and complexity of next-generation cryogenic engineering. Bluefors, a Finnish company, is recognized as a global leader in commercial dilution refrigerators, supplying systems to major quantum computing initiatives worldwide. Oxford Instruments also plays a pivotal role, offering cryogenic solutions tailored for both research and industrial quantum computing applications.

The period from 2025 onward is expected to see significant scaling of quantum processors, with roadmaps from industry leaders targeting devices with hundreds to thousands of qubits. This scaling intensifies the demand for robust, reliable, and scalable cryogenic platforms. Key engineering challenges include managing increased heat loads from control wiring, ensuring vibration isolation, and automating cryostat operation for continuous uptime. Companies are responding with innovations such as cryo-compatible electronics, modular cryostat designs, and improved thermal management systems.

Collaborations between quantum hardware firms and cryogenic specialists are accelerating. For example, IBM and Bluefors have announced joint efforts to develop next-generation cryogenic infrastructure capable of supporting large-scale quantum systems. Additionally, suppliers like Oxford Instruments are expanding their product lines to address the unique requirements of quantum computing, including higher cooling power and enhanced system integration.

Looking ahead to 2030, the outlook for cryogenic engineering in quantum computing is marked by continued growth and technical refinement. As quantum computers move from laboratory prototypes to commercial deployment, the cryogenic sector will play a decisive role in enabling reliable, scalable, and cost-effective quantum technologies. The next five years will likely witness further consolidation among cryogenic suppliers, increased automation, and the emergence of standardized platforms tailored for quantum computing’s evolving needs.

Market Size, Growth Forecasts, and Key Drivers (2025–2030)

The market for cryogenic engineering solutions tailored to quantum computing systems is poised for significant expansion between 2025 and 2030, driven by the rapid evolution of quantum hardware and the increasing demand for ultra-low temperature environments. Quantum computers, particularly those based on superconducting qubits and spin qubits, require stable operation at temperatures close to absolute zero, typically in the millikelvin range. This necessity has positioned cryogenic engineering as a critical enabler for the quantum computing industry.

As of 2025, the global quantum computing sector is witnessing accelerated investment from both public and private entities, with cryogenic infrastructure representing a substantial portion of capital expenditure for new quantum data centers and research facilities. Leading quantum hardware developers such as IBM, Google, and Rigetti Computing rely on advanced dilution refrigerators and cryostats to maintain the operational integrity of their quantum processors. The demand for these systems is expected to grow in tandem with the scaling of quantum processors from tens to hundreds and eventually thousands of qubits.

Key suppliers in the cryogenic engineering market include Bluefors, a Finnish company recognized for its high-performance dilution refrigerators, and Oxford Instruments, a UK-based manufacturer with a broad portfolio of cryogenic and superconducting technologies. Both companies have reported increased orders from quantum computing customers and are expanding their manufacturing capacities to meet anticipated demand. Cryomech and Linde are also notable players, providing cryocoolers and helium liquefaction systems essential for large-scale quantum installations.

Several factors are driving market growth through 2030:

- Continued scaling of quantum processors, necessitating larger and more complex cryogenic systems.

- Government and industry investments in national quantum initiatives, which often include funding for cryogenic infrastructure.

- Technological advances in cryogenics, such as improved cooling power, lower vibration, and automation, which reduce operational costs and complexity.

- Emergence of quantum cloud services, requiring robust and reliable cryogenic platforms for remote quantum access.

Looking ahead, the cryogenic engineering market for quantum computing is expected to maintain double-digit annual growth rates, with the potential for new entrants and partnerships as the ecosystem matures. The focus will increasingly shift toward energy efficiency, system integration, and scalability, as quantum computers transition from laboratory prototypes to commercial-scale deployments.

Core Cryogenic Technologies: Dilution Refrigerators, Pulse Tubes, and Helium Systems

Cryogenic engineering is a foundational pillar for quantum computing systems, as quantum bits (qubits) based on superconducting circuits, spin qubits, and other modalities require ultra-low temperatures—often below 20 millikelvin—to maintain coherence and minimize thermal noise. In 2025, the field is witnessing rapid advancements in core cryogenic technologies, particularly in dilution refrigerators, pulse tube cryocoolers, and helium management systems, all of which are critical for scaling quantum processors.

Dilution refrigerators remain the gold standard for achieving millikelvin temperatures necessary for superconducting and spin-based qubits. Leading manufacturers such as Bluefors and Oxford Instruments have introduced new models with increased cooling power, larger experimental volumes, and improved wiring integration to support quantum processors with hundreds or even thousands of qubits. For example, Bluefors’ latest platforms are designed to accommodate the growing complexity of quantum hardware, offering modularity and automation features that reduce downtime and facilitate remote operation—an increasingly important factor as quantum computing research becomes more distributed globally.

Pulse tube cryocoolers are now the preferred pre-cooling technology, replacing traditional liquid helium bath systems due to their reliability and reduced operational costs. Companies like Cryomech and Sumitomo Heavy Industries supply pulse tube coolers that are integrated into dilution refrigerator systems, enabling continuous, vibration-minimized cooling without the need for frequent cryogen refills. This shift is crucial for both research and commercial quantum computing deployments, where system uptime and maintenance costs are key considerations.

Helium management remains a significant challenge, given the scarcity and cost of helium-3 and helium-4 isotopes. In response, system integrators and suppliers are developing closed-cycle helium recovery and liquefaction systems to minimize losses and ensure sustainable operation. Oxford Instruments and Bluefors are both investing in helium recycling solutions, while also optimizing their refrigerators for lower helium consumption.

Looking ahead, the next few years are expected to bring further integration of cryogenic engineering with quantum control electronics, as companies such as Intel and IBM pursue cryo-CMOS and other low-temperature electronics to reduce wiring complexity and thermal load. The convergence of advanced cryogenics, automation, and scalable infrastructure will be essential for the transition from laboratory-scale quantum devices to commercially viable quantum computing systems.

Major Players and Strategic Partnerships (e.g., Bluefors, Oxford Instruments, Quantum Machines)

The cryogenic engineering landscape for quantum computing systems in 2025 is defined by a handful of specialized companies and a growing web of strategic partnerships. These collaborations are crucial for advancing the scale, reliability, and integration of quantum computers, which require ultra-low temperature environments to operate superconducting qubits and other quantum devices.

Bluefors, headquartered in Finland, remains a global leader in the manufacture of dilution refrigerators, the core cryogenic platforms for quantum computing. Their systems are widely adopted by both academic and industrial quantum computing labs, with a reputation for reliability and modularity. In recent years, Bluefors has expanded its product line to address the increasing demand for larger, more complex cryogenic systems capable of supporting hundreds or even thousands of qubits. The company has also entered into high-profile partnerships with quantum hardware developers and national laboratories, aiming to co-develop next-generation cryogenic infrastructure tailored for scalable quantum processors.

Another major player, Oxford Instruments, based in the UK, continues to innovate in cryogenic and measurement solutions for quantum technologies. Oxford Instruments offers a range of cryofree dilution refrigerators and integrated measurement systems, and has been actively collaborating with quantum computing startups and established technology firms. Their recent focus includes automation, remote monitoring, and integration with quantum control electronics, reflecting the industry’s push toward more user-friendly and scalable quantum platforms.

On the electronics and control side, Quantum Machines from Israel has emerged as a key partner for both Bluefors and Oxford Instruments. Quantum Machines specializes in quantum orchestration platforms—hardware and software stacks that interface with cryogenic systems to control and read out qubits. Their solutions are increasingly being bundled with cryogenic hardware, enabling end-users to deploy more complete, turnkey quantum computing stacks. Strategic alliances between Quantum Machines and cryogenic system manufacturers are expected to deepen, as seamless integration between control electronics and cryogenic environments becomes a critical requirement for scaling up quantum computers.

Other notable companies include Linde, which supplies cryogenic gases and infrastructure, and JanisULT, a subsidiary of Lake Shore Cryotronics, which provides custom cryogenic solutions for quantum research. These firms are increasingly collaborating with quantum hardware developers to address challenges such as thermal management, wiring density, and system automation.

Looking ahead, the next few years will likely see further consolidation and partnership-driven innovation, as quantum computing moves from laboratory prototypes to early commercial deployments. The interplay between cryogenic engineering specialists and quantum hardware companies will be pivotal in overcoming the technical barriers to large-scale, fault-tolerant quantum computing.

Emerging Materials and Advanced Cooling Techniques

Cryogenic engineering is a cornerstone of quantum computing, as most quantum processors—particularly those based on superconducting qubits—require operation at temperatures near absolute zero. In 2025, the field is witnessing rapid innovation in both materials and cooling technologies, driven by the scaling ambitions of quantum hardware developers and the need for greater system reliability and efficiency.

A key trend is the development and deployment of advanced dilution refrigerators, which are essential for maintaining the sub-20 millikelvin environments required by leading quantum processors. Companies such as Bluefors and Oxford Instruments are at the forefront, supplying modular, high-capacity cryostats tailored for multi-qubit systems. These systems are being engineered for higher cooling power, improved thermal stability, and easier integration with complex wiring and control electronics, addressing the challenges posed by scaling quantum processors to hundreds or thousands of qubits.

Emerging materials are also playing a pivotal role. High-purity metals, low-loss dielectrics, and advanced superconductors are being adopted to minimize thermal noise and decoherence. For instance, the use of niobium-titanium alloys and high-purity copper in cryogenic wiring and shielding is becoming standard, as these materials offer superior thermal conductivity and electromagnetic shielding at millikelvin temperatures. Additionally, research into new superconducting materials and surface treatments aims to further reduce energy losses and extend qubit coherence times.

Another area of innovation is the integration of cryogenic-compatible electronics, such as amplifiers and multiplexers, directly within the cryostat. Companies like Intel and IBM are actively developing cryo-CMOS and other low-temperature electronics to reduce the thermal load and signal degradation associated with long wiring runs between room-temperature and cryogenic environments. This approach is expected to become increasingly important as quantum processors grow in complexity and require more sophisticated control and readout infrastructure.

Looking ahead, the next few years are likely to see further advances in both materials science and cryogenic engineering. The push toward larger, more reliable quantum systems is driving demand for even more efficient cooling solutions, such as closed-cycle dilution refrigerators and novel cryocooler designs. Collaboration between quantum hardware developers, cryogenic equipment manufacturers, and materials scientists will be critical to overcoming the thermal and engineering challenges of next-generation quantum computers.

Integration Challenges: Scalability, Reliability, and Cost Reduction

Cryogenic engineering is a cornerstone of quantum computing, enabling the ultra-low temperatures required for superconducting qubits and other quantum devices. As the quantum computing sector moves into 2025, integration challenges related to scalability, reliability, and cost reduction are at the forefront of both research and commercial development.

Scalability remains a primary hurdle. Current quantum processors, such as those developed by IBM and Bluefors (a leading supplier of dilution refrigerators), require complex cryogenic systems to maintain operational temperatures below 20 millikelvin. As quantum processors scale from tens to potentially thousands of qubits, the physical size and complexity of cryogenic wiring, thermal management, and shielding increase exponentially. Companies like Bluefors and Oxford Instruments are actively developing modular and higher-capacity cryostats to address these needs, with recent announcements of systems designed for multi-qubit arrays and integrated control electronics.

Reliability is another critical concern. Quantum computers must operate continuously at cryogenic temperatures, often for weeks or months, to support research and commercial workloads. Even minor thermal fluctuations or vibrations can disrupt qubit coherence. To address this, manufacturers are investing in advanced vibration isolation, automated thermal cycling, and remote monitoring. Oxford Instruments has introduced cryogenic platforms with enhanced uptime and serviceability, while Bluefors is collaborating with quantum hardware developers to co-design systems that minimize downtime and maintenance.

Cost reduction is essential for broader adoption. Traditional dilution refrigerators are expensive, both in capital and operational expenditure, due to their complexity and the need for specialized infrastructure. In response, industry leaders are pursuing innovations such as cryo-compatible electronics, compact cryostats, and more efficient cooling cycles. IBM has publicly discussed efforts to reduce the footprint and cost of their cryogenic systems as part of their quantum roadmap, aiming to make quantum computing more accessible to research institutions and enterprises.

Looking ahead, the next few years are expected to see further integration of cryogenic and quantum hardware, with a focus on modularity, automation, and hybrid cooling solutions. Partnerships between cryogenic specialists and quantum hardware companies are likely to accelerate, driving advances in system reliability and cost-effectiveness. As the quantum ecosystem matures, the evolution of cryogenic engineering will be pivotal in enabling practical, large-scale quantum computing deployments.

Regulatory Standards and Industry Initiatives (e.g., IEEE, ASME)

The rapid advancement of quantum computing has placed unprecedented demands on cryogenic engineering, necessitating robust regulatory standards and coordinated industry initiatives. As of 2025, the sector is witnessing a concerted effort to formalize guidelines and best practices, particularly as quantum processors increasingly rely on dilution refrigerators and ultra-low temperature systems for stable operation.

Key standards organizations, such as the IEEE and the ASME, are actively engaged in developing frameworks that address the unique requirements of cryogenic systems for quantum computing. The IEEE, for example, has established working groups focused on quantum technologies, including the IEEE Quantum Initiative, which is collaborating with industry stakeholders to define interoperability, safety, and performance benchmarks for cryogenic hardware. These efforts are expected to yield new technical standards over the next few years, with draft guidelines anticipated for public review by late 2025.

Similarly, the ASME is leveraging its expertise in pressure vessel and cryogenic piping codes to adapt existing standards for the specialized needs of quantum computing infrastructure. The ASME Boiler and Pressure Vessel Code (BPVC) and the B31.3 Process Piping Code are being referenced and, where necessary, updated to ensure compatibility with the materials and operational regimes encountered in quantum cryogenics. Industry feedback is being solicited through technical committees, with a focus on harmonizing safety protocols and inspection procedures for dilution refrigerators and related equipment.

On the industry side, leading cryogenic equipment manufacturers such as Bluefors and Oxford Instruments are participating in these standardization efforts, contributing data from field deployments and collaborating on best practices for system integration and maintenance. Both companies are also involved in joint initiatives with quantum computing firms to ensure that cryogenic platforms meet the reliability and scalability demands of next-generation quantum processors.

In addition, consortia such as the Quantum Economic Development Consortium (QED-C) are facilitating cross-sector dialogue, bringing together hardware suppliers, quantum computing companies, and standards bodies to accelerate the adoption of unified guidelines. These initiatives are expected to play a pivotal role in shaping regulatory landscapes, with the goal of reducing barriers to deployment and fostering global interoperability.

Looking ahead, the next few years will likely see the formalization of cryogenic engineering standards tailored to quantum computing, with increased emphasis on safety, reliability, and environmental sustainability. As quantum systems scale up, adherence to these evolving standards will be critical for ensuring operational excellence and supporting the broader commercialization of quantum technologies.

Regional Analysis: North America, Europe, Asia-Pacific Trends

The regional landscape for cryogenic engineering in quantum computing systems is rapidly evolving, with North America, Europe, and Asia-Pacific each demonstrating distinct trends and strategic priorities as of 2025 and looking ahead.

North America remains at the forefront of cryogenic engineering for quantum computing, driven by the presence of major technology companies and a robust ecosystem of specialized suppliers. The United States, in particular, is home to leading quantum hardware developers such as IBM and Google, both of which have made significant investments in dilution refrigerator technology and ultra-low temperature infrastructure. Companies like Bluefors and Cryomech supply advanced cryostats and cryocoolers to support these efforts. The region benefits from strong government funding and public-private partnerships, with the U.S. Department of Energy and National Science Foundation supporting quantum research and infrastructure development. In Canada, firms such as D-Wave Systems are also advancing cryogenic integration for quantum annealers.

Europe is intensifying its focus on cryogenic engineering, propelled by the European Union’s Quantum Flagship initiative and national programs in countries like Germany, the Netherlands, and Finland. European cryogenics specialists such as Oxford Instruments and Bluefors (headquartered in Finland) are key suppliers of dilution refrigerators and cryogenic platforms for quantum computing labs and startups. The region is witnessing increased collaboration between academia and industry, with research centers and companies working together to develop scalable, reliable cryogenic systems. The outlook for 2025 and beyond includes further investment in local manufacturing and supply chains to reduce dependence on imports and enhance technological sovereignty.

Asia-Pacific is emerging as a dynamic growth region, with China, Japan, and South Korea making substantial investments in quantum computing infrastructure, including cryogenic engineering. Chinese technology giants and research institutes are developing indigenous cryogenic solutions to support national quantum initiatives. Japan’s established electronics sector, with companies like NEC Corporation, is also exploring advanced cryogenic systems for superconducting qubits. Australia is notable for its research in silicon-based quantum technologies, which require specialized cryogenic environments. The region is expected to see rapid expansion in local cryogenic manufacturing capabilities and increased collaboration with global suppliers.

Across all regions, the next few years will likely see intensified efforts to improve the efficiency, scalability, and automation of cryogenic systems, as quantum computing moves from laboratory prototypes toward commercial deployment. The global supply chain for cryogenic components is expected to become more interconnected, with regional hubs specializing in different aspects of cryogenic engineering and system integration.

Investment Landscape and Funding Outlook

The investment landscape for cryogenic engineering in quantum computing systems is experiencing significant momentum as the quantum technology sector matures and approaches commercial viability. Cryogenic infrastructure—essential for maintaining the ultra-low temperatures required by superconducting and spin-based quantum processors—has become a focal point for both private and public funding initiatives. In 2025, the sector is characterized by a blend of established industrial players, quantum hardware startups, and strategic partnerships with government agencies.

Major cryogenic equipment manufacturers such as Oxford Instruments and Bluefors continue to attract investment and expand their production capacities to meet the growing demand from quantum computing companies and research institutions. Oxford Instruments, with its long-standing expertise in dilution refrigerators, has reported increased orders from both commercial and academic quantum initiatives. Bluefors, a leading supplier of cryogenic systems for quantum applications, has announced new facility expansions and collaborations with quantum hardware developers, reflecting the sector’s robust growth trajectory.

Venture capital and corporate investment in cryogenic engineering startups have also accelerated. Companies such as Cryomech and Linde are leveraging their cryogenics expertise to develop next-generation cooling solutions tailored for scalable quantum processors. These firms are increasingly the recipients of targeted funding rounds, often in conjunction with quantum computing hardware startups seeking to vertically integrate their supply chains.

Government funding remains a critical driver. National quantum initiatives in the US, EU, and Asia are allocating substantial resources to cryogenic infrastructure as part of broader quantum technology roadmaps. For example, the European Quantum Flagship program and the US National Quantum Initiative are supporting collaborative projects that include cryogenic engineering as a core component, fostering public-private partnerships and technology transfer.

Looking ahead to the next few years, the funding outlook for cryogenic engineering in quantum computing is expected to remain strong. The anticipated scaling of quantum processors—from tens to hundreds or thousands of qubits—will require more advanced, reliable, and cost-effective cryogenic systems. This is likely to spur further investment in R&D, manufacturing capacity, and supply chain resilience. As quantum computing moves closer to practical deployment, the strategic importance of cryogenic engineering will continue to attract capital from both traditional industrial players and new entrants, ensuring a dynamic and competitive investment environment through the late 2020s.

Future Outlook: Disruptive Innovations and Market Opportunities Through 2030

The future of cryogenic engineering for quantum computing systems is poised for significant transformation through 2030, driven by the escalating demand for scalable, reliable, and cost-effective cooling solutions. As quantum processors—particularly those based on superconducting qubits and spin qubits—require operation at millikelvin temperatures, the cryogenics sector is experiencing rapid innovation to meet the unique needs of quantum hardware.

Key industry players are investing heavily in next-generation dilution refrigerators and closed-cycle cryostats. Bluefors, a global leader in cryogenic systems, continues to expand its product line with modular, high-capacity refrigerators designed for large-scale quantum processors. Their recent collaborations with quantum computing companies and research institutions underscore the trend toward integrated, turnkey cryogenic platforms. Similarly, Oxford Instruments is advancing its Proteox line, focusing on automation, remote monitoring, and enhanced thermal stability to support multi-qubit scaling and reduce system downtime.

Emerging disruptive innovations include the development of cryo-compatible electronics and photonics, which aim to minimize heat load and wiring complexity inside the cryostat. Companies such as Intel are actively researching cryogenic CMOS controllers, which could enable more efficient qubit control and readout at low temperatures, potentially reducing the need for extensive room-temperature electronics. Additionally, the integration of photonic interconnects for cryogenic environments is being explored to facilitate high-bandwidth, low-loss communication between quantum chips and classical control systems.

The market outlook through 2030 anticipates a shift from bespoke, research-focused cryogenic setups to standardized, mass-manufacturable platforms. This transition is expected to lower costs and accelerate the deployment of quantum computers in commercial and cloud environments. IBM and Leiden Cryogenics are among those working on scalable infrastructure to support quantum data centers, with an emphasis on energy efficiency and operational reliability.

Looking ahead, the convergence of cryogenic engineering with advanced materials, AI-driven system optimization, and sustainable cooling technologies will likely open new market opportunities. The push for eco-friendly refrigerants and reduced power consumption aligns with broader industry sustainability goals. As quantum computing moves toward practical utility, the cryogenics sector is set to become a cornerstone of the quantum technology supply chain, with robust growth and disruptive innovation expected well into the next decade.

Sources & References

- IBM

- Oxford Instruments

- Bluefors

- Rigetti Computing

- Cryomech

- Linde

- Bluefors

- Oxford Instruments

- Cryomech

- IBM

- JanisULT

- IEEE

- ASME

- NEC Corporation

- Linde