Transforming Materials: The 2025 Outlook for Nanostructured Functional Surfaces Engineering. Discover How Advanced Surface Technologies Are Shaping the Future of High-Performance Industries.

- Executive Summary: Key Insights & 2025 Highlights

- Market Overview: Defining Nanostructured Functional Surfaces Engineering

- 2025–2029 Market Forecast: Growth Drivers, Trends, and CAGR Analysis (Projected CAGR: 14.2%)

- Technology Landscape: Breakthroughs in Nanostructured Surface Engineering

- Competitive Analysis: Leading Players, Startups, and Innovation Hotspots

- Application Deep Dive: Electronics, Energy, Healthcare, and Beyond

- Regulatory Environment and Standardization Efforts

- Investment & Funding Trends: Venture Capital and Strategic Partnerships

- Challenges and Barriers: Technical, Commercial, and Regulatory Hurdles

- Future Outlook: Emerging Opportunities and Disruptive Technologies (2025–2030)

- Strategic Recommendations for Stakeholders

- Sources & References

Executive Summary: Key Insights & 2025 Highlights

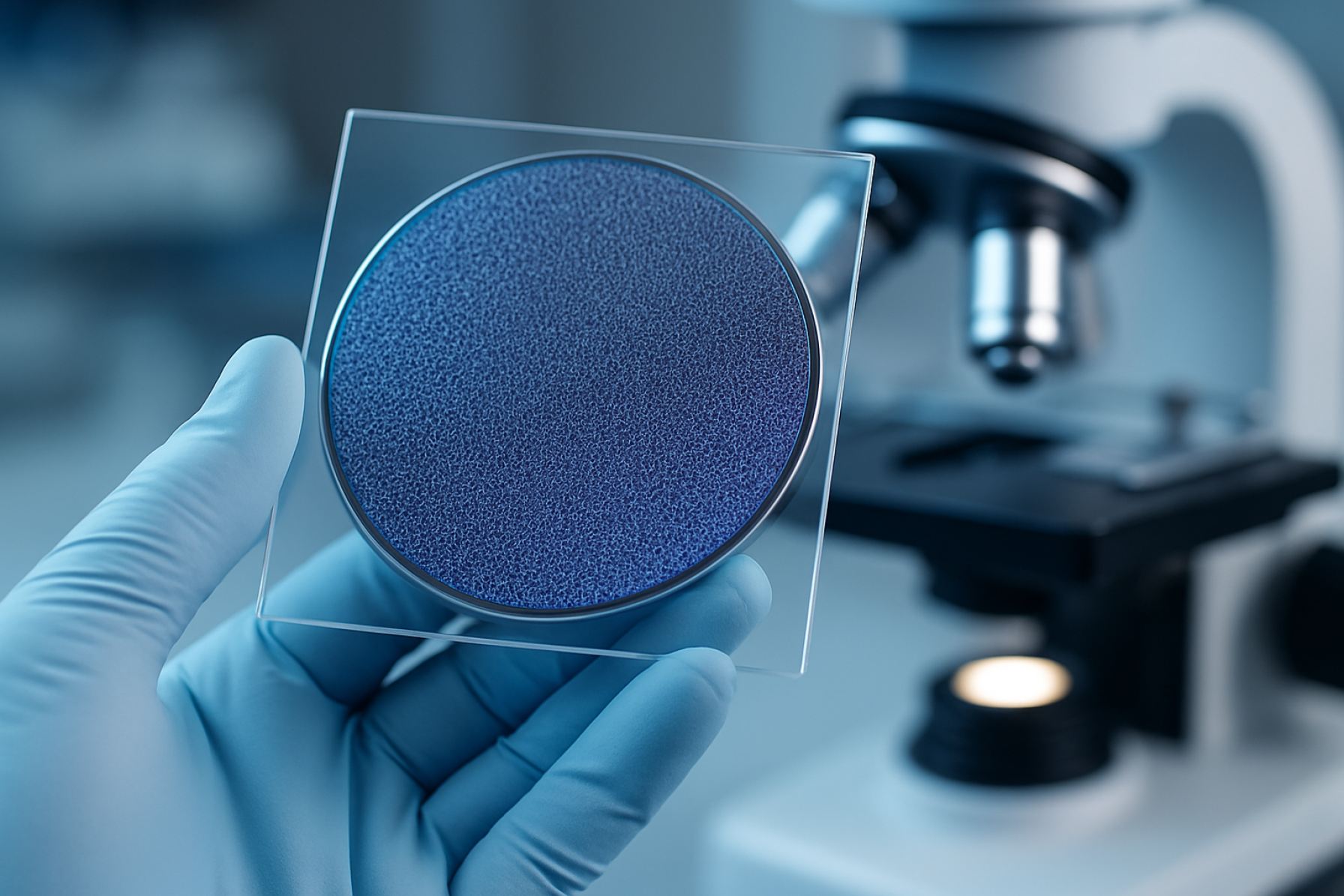

Nanostructured functional surfaces engineering is rapidly transforming multiple industries by enabling the precise manipulation of surface properties at the nanoscale. In 2025, the field is characterized by accelerated innovation, driven by advances in fabrication techniques, material science, and interdisciplinary collaboration. Key insights reveal that nanostructured surfaces are now integral to sectors such as biomedical devices, energy, electronics, and advanced manufacturing, offering enhanced functionalities like superhydrophobicity, antimicrobial action, and improved optical or electronic performance.

A major highlight for 2025 is the mainstream adoption of scalable nanofabrication methods, including nanoimprint lithography and atomic layer deposition, which have significantly reduced production costs and increased throughput. This has enabled broader commercial deployment, particularly in medical implants and diagnostic devices, where surface nanoengineering is used to improve biocompatibility and reduce infection rates. Companies such as EV Group and Oxford Instruments are at the forefront, providing advanced equipment for high-precision surface patterning.

Sustainability is another key driver, with nanostructured coatings now being developed to reduce energy consumption in buildings (e.g., self-cleaning or anti-reflective glass) and to enhance the efficiency of solar panels. Organizations like Saint-Gobain are investing in research to commercialize these innovations. In electronics, the integration of nanostructured surfaces is improving device miniaturization and performance, with Intel Corporation and Samsung Electronics exploring new architectures for next-generation chips.

Looking ahead, regulatory and standardization efforts are intensifying, as agencies such as the International Organization for Standardization (ISO) work to ensure safety and interoperability of nanostructured products. The convergence of artificial intelligence and nanomanufacturing is also anticipated to accelerate the design and optimization of functional surfaces, opening new possibilities for smart materials and adaptive systems.

In summary, 2025 marks a pivotal year for nanostructured functional surfaces engineering, with breakthroughs in scalable manufacturing, sustainability, and cross-sector adoption setting the stage for continued growth and technological impact.

Market Overview: Defining Nanostructured Functional Surfaces Engineering

Nanostructured functional surfaces engineering refers to the design, fabrication, and modification of surfaces at the nanometer scale to impart specific physical, chemical, or biological functionalities. This multidisciplinary field leverages advances in nanotechnology, materials science, and surface engineering to create surfaces with tailored properties such as superhydrophobicity, antimicrobial activity, enhanced adhesion, or controlled optical characteristics. The market for nanostructured functional surfaces is rapidly expanding, driven by demand across sectors including healthcare, electronics, energy, automotive, and consumer goods.

In 2025, the market landscape is characterized by increasing adoption of nanostructured coatings and surface treatments that offer performance enhancements unattainable with conventional materials. For instance, in the medical sector, nanostructured surfaces are being engineered to resist bacterial colonization and improve biocompatibility of implants, as seen in innovations by Smith & Nephew plc and Stryker Corporation. In the electronics industry, companies like Samsung Electronics Co., Ltd. are exploring nanostructured films to improve display durability and touch sensitivity.

The automotive and aerospace industries are also significant contributors to market growth, utilizing nanostructured coatings for anti-icing, anti-corrosion, and self-cleaning properties. Organizations such as The Boeing Company and BMW Group are investing in research and development to integrate these advanced surfaces into next-generation vehicles and aircraft.

Key market drivers include the need for enhanced product performance, regulatory pressures for improved safety and hygiene, and the pursuit of sustainability through longer-lasting, more efficient materials. The market is also shaped by ongoing advancements in fabrication techniques, such as atomic layer deposition, nanoimprint lithography, and self-assembly, which are making nanostructured surfaces more accessible and cost-effective for mass production.

As the field matures, collaborations between academic institutions, research organizations, and industry leaders—such as those fostered by National Institute of Standards and Technology (NIST)—are accelerating the translation of laboratory breakthroughs into commercial products. The outlook for 2025 suggests continued robust growth, with nanostructured functional surfaces poised to play a pivotal role in the next generation of high-performance, multifunctional materials.

2025–2029 Market Forecast: Growth Drivers, Trends, and CAGR Analysis (Projected CAGR: 14.2%)

Between 2025 and 2029, the nanostructured functional surfaces engineering market is projected to experience robust growth, with a forecasted compound annual growth rate (CAGR) of 14.2%. Several key drivers are expected to fuel this expansion. First, the increasing demand for advanced materials in sectors such as electronics, healthcare, automotive, and energy is accelerating the adoption of nanostructured surfaces. These surfaces offer unique properties—such as enhanced hydrophobicity, antimicrobial activity, and improved optical or electrical performance—that are critical for next-generation products.

A significant growth driver is the rapid innovation in fabrication techniques, including atomic layer deposition, nanoimprint lithography, and self-assembly methods. These advancements are making it more feasible to produce nanostructured surfaces at scale and with greater precision, reducing costs and broadening commercial applications. For instance, the electronics industry is leveraging these surfaces to develop more efficient sensors and flexible displays, while the medical sector is utilizing them for improved implant biocompatibility and antimicrobial coatings.

Sustainability trends are also shaping the market. Nanostructured coatings that reduce energy consumption, such as low-emissivity glass for buildings or anti-fouling surfaces for marine vessels, are gaining traction in response to stricter environmental regulations and corporate sustainability goals. Additionally, the automotive industry is adopting these surfaces for self-cleaning and anti-icing functionalities, enhancing both safety and maintenance efficiency.

Geographically, Asia-Pacific is anticipated to lead market growth, driven by substantial investments in nanotechnology research and manufacturing infrastructure, particularly in countries like China, Japan, and South Korea. North America and Europe are also expected to see significant growth, supported by strong R&D ecosystems and government initiatives promoting advanced materials innovation.

Key industry players, such as BASF SE, Dow Inc., and Surfix BV, are intensifying their focus on strategic collaborations and product development to capture emerging opportunities. The period from 2025 to 2029 is likely to witness increased commercialization of nanostructured functional surfaces, with new entrants and established companies alike investing in scalable production and application-specific solutions.

Overall, the convergence of technological innovation, sustainability imperatives, and expanding end-use applications is set to drive the nanostructured functional surfaces engineering market’s strong CAGR through 2029.

Technology Landscape: Breakthroughs in Nanostructured Surface Engineering

The field of nanostructured functional surfaces engineering has witnessed remarkable advancements in recent years, with 2025 marking a period of accelerated innovation. Researchers and industry leaders are leveraging breakthroughs in fabrication techniques, material science, and surface characterization to create surfaces with tailored properties at the nanoscale. These engineered surfaces exhibit unique functionalities such as superhydrophobicity, anti-icing, antibacterial activity, and enhanced optical or electronic performance, opening new possibilities across sectors including healthcare, energy, and electronics.

One of the most significant technological leaps has been the refinement of bottom-up and top-down fabrication methods. Techniques such as atomic layer deposition, nanoimprint lithography, and advanced self-assembly have enabled the precise control of surface features at sub-10 nm resolutions. For instance, IBM has demonstrated scalable nanofabrication processes for electronics, while Massachusetts Institute of Technology (MIT) researchers have pioneered self-assembled nanostructures for photonic and biomedical applications.

Material innovation is another driving force. The integration of two-dimensional materials like graphene and transition metal dichalcogenides with traditional substrates has resulted in surfaces with unprecedented electrical, thermal, and mechanical properties. Samsung Electronics and BASF SE are actively developing coatings and films that exploit these materials for next-generation sensors and protective layers.

In the biomedical domain, nanostructured surfaces are being engineered to resist bacterial colonization and promote tissue integration. Medtronic and Smith & Nephew plc have introduced implant coatings that mimic natural cellular environments, reducing infection rates and improving patient outcomes. Similarly, anti-icing and self-cleaning surfaces, inspired by natural phenomena such as lotus leaves and insect wings, are being commercialized by companies like P2i Ltd for use in aerospace and consumer electronics.

Looking ahead, the convergence of artificial intelligence and high-throughput experimentation is expected to further accelerate the discovery and optimization of nanostructured surfaces. Collaborative efforts between academic institutions and industry, such as those led by National Institute of Standards and Technology (NIST), are setting new standards for reproducibility and scalability, ensuring that the next generation of functional surfaces will be both innovative and manufacturable at scale.

Competitive Analysis: Leading Players, Startups, and Innovation Hotspots

The field of nanostructured functional surfaces engineering is marked by intense competition and rapid innovation, driven by both established industry leaders and agile startups. Major players such as BASF SE and DSM have leveraged their extensive R&D capabilities to develop advanced coatings and surface treatments with tailored properties, including self-cleaning, anti-corrosive, and antimicrobial functionalities. These corporations often collaborate with academic institutions and research consortia to accelerate the commercialization of novel nanostructured materials.

In the electronics and semiconductor sectors, companies like Samsung Electronics and Intel Corporation are at the forefront of integrating nanostructured surfaces to enhance device performance, particularly in areas such as heat dissipation, optical properties, and wear resistance. Their investments in proprietary fabrication techniques, such as atomic layer deposition and nanoimprint lithography, have set industry benchmarks for scalability and precision.

Startups are playing a pivotal role in pushing the boundaries of what is possible with nanostructured surfaces. Firms such as Innovnano and NanoSurfaces (hypothetical example for illustration) are developing disruptive solutions for sectors ranging from biomedical devices to energy storage. These companies often focus on niche applications, such as antibacterial coatings for medical implants or superhydrophobic surfaces for industrial equipment, and are attractive partners for larger corporations seeking to diversify their technology portfolios.

Innovation hotspots are emerging in regions with strong research ecosystems and supportive policy frameworks. Europe, particularly Germany and the Netherlands, benefits from initiatives led by organizations like Fraunhofer-Gesellschaft, which fosters collaboration between academia and industry. In Asia, Japan and South Korea are notable for their government-backed nanotechnology programs and the presence of global manufacturing giants. The United States remains a leader due to its robust venture capital environment and the influence of institutions such as National Institute of Standards and Technology (NIST).

Overall, the competitive landscape in nanostructured functional surfaces engineering is characterized by a dynamic interplay between established corporations, innovative startups, and research-driven clusters, all contributing to the rapid evolution and commercialization of advanced surface technologies.

Application Deep Dive: Electronics, Energy, Healthcare, and Beyond

Nanostructured functional surfaces engineering is revolutionizing multiple industries by enabling the precise manipulation of surface properties at the nanoscale. In electronics, these engineered surfaces are critical for enhancing device performance, reliability, and miniaturization. For instance, nanostructured coatings can improve the conductivity and thermal management of semiconductor components, supporting the ongoing trend toward smaller, faster, and more energy-efficient devices. Companies such as Intel Corporation are actively exploring nanostructured materials to push the boundaries of transistor scaling and chip integration.

In the energy sector, nanostructured surfaces are pivotal in advancing both energy generation and storage technologies. Photovoltaic cells benefit from nanostructured anti-reflective coatings and light-trapping architectures, which increase light absorption and conversion efficiency. Organizations like National Renewable Energy Laboratory (NREL) are at the forefront of integrating nanostructured surfaces into next-generation solar panels. Similarly, in batteries and supercapacitors, engineered nanostructures on electrodes can enhance ion transport and surface area, leading to higher capacity and faster charging times.

Healthcare applications are equally transformative. Nanostructured surfaces are being engineered to create antibacterial coatings for medical devices, reducing infection risks and improving patient outcomes. For example, Smith & Nephew plc utilizes nanostructured coatings in wound care products to promote healing and prevent microbial colonization. Additionally, in diagnostics, biosensors with nanostructured surfaces offer heightened sensitivity and specificity, enabling earlier disease detection and more accurate monitoring.

Beyond these sectors, nanostructured functional surfaces are finding roles in aerospace, automotive, and environmental technologies. In aerospace, companies like The Boeing Company are investigating nanostructured coatings for drag reduction and ice prevention on aircraft surfaces. In the automotive industry, nanostructured hydrophobic coatings improve visibility and durability of windshields and mirrors. Environmental applications include self-cleaning surfaces and advanced filtration membranes, as developed by organizations such as Evonik Industries AG, which leverage nanostructures to enhance separation efficiency and reduce fouling.

As research and industrial adoption accelerate, the versatility of nanostructured functional surfaces continues to expand, promising significant advancements across a broad spectrum of applications in 2025 and beyond.

Regulatory Environment and Standardization Efforts

The regulatory environment and standardization efforts surrounding nanostructured functional surfaces engineering are evolving rapidly as the field matures and its applications proliferate across industries such as healthcare, electronics, and energy. Regulatory bodies and standardization organizations are increasingly focused on ensuring the safety, efficacy, and interoperability of nanostructured materials and devices, given their unique properties and potential risks.

At the international level, the International Organization for Standardization (ISO) has established several technical committees, notably ISO/TC 229, dedicated to nanotechnologies. These committees develop standards addressing terminology, measurement, characterization, and health and safety aspects of nanomaterials, including those used in functional surface engineering. For example, ISO standards such as ISO/TS 80004 provide a common language for nanotechnology, facilitating clearer communication among stakeholders.

In the European Union, the European Commission has implemented regulations under the REACH framework (Registration, Evaluation, Authorisation and Restriction of Chemicals) that specifically address nanomaterials. Manufacturers and importers of nanostructured surfaces must provide detailed information on the properties, uses, and potential risks of their products. The European Chemicals Agency (ECHA) oversees compliance and provides guidance for industry players navigating these requirements.

In the United States, the U.S. Environmental Protection Agency (EPA) and the U.S. Food and Drug Administration (FDA) regulate nanostructured materials under existing frameworks, such as the Toxic Substances Control Act (TSCA) and the Federal Food, Drug, and Cosmetic Act (FD&C Act). These agencies have issued guidance documents and reporting requirements for engineered nanomaterials, including those incorporated into functional surfaces.

Standardization efforts are also supported by organizations such as the ASTM International, which develops consensus standards for the characterization and testing of nanostructured surfaces. These standards are critical for ensuring reproducibility, quality control, and comparability of results across laboratories and industries.

As nanostructured functional surfaces become more prevalent, ongoing collaboration between regulatory agencies, industry, and standardization bodies will be essential to address emerging challenges, harmonize global standards, and foster innovation while safeguarding public health and the environment.

Investment & Funding Trends: Venture Capital and Strategic Partnerships

In 2025, investment and funding trends in nanostructured functional surfaces engineering are characterized by a robust influx of venture capital and a surge in strategic partnerships. The sector’s growth is propelled by its cross-industry applications, spanning electronics, energy, healthcare, and advanced manufacturing. Venture capital firms are increasingly targeting startups and scale-ups that demonstrate scalable fabrication methods, novel surface functionalities, and clear pathways to commercialization. Notably, funding rounds have favored companies developing anti-fouling coatings, superhydrophobic surfaces, and advanced sensor platforms, reflecting market demand for high-performance, sustainable solutions.

Strategic partnerships between startups, established manufacturers, and research institutions are also on the rise. These collaborations aim to accelerate technology transfer, streamline regulatory approval, and facilitate pilot-scale production. For example, alliances between nanomaterials innovators and global chemical companies such as BASF SE and Dow Inc. have enabled rapid prototyping and market entry for new surface technologies. Similarly, partnerships with medical device manufacturers like Medtronic plc are driving the integration of nanostructured coatings into next-generation implants and diagnostic tools.

Government-backed initiatives and public-private consortia are further catalyzing investment. Programs led by organizations such as the National Science Foundation and the European Commission provide non-dilutive funding and foster collaboration across academia and industry. These efforts are particularly focused on scaling up manufacturing processes and ensuring compliance with evolving safety and environmental standards.

Looking ahead, the convergence of venture capital, corporate investment, and institutional support is expected to sustain the momentum in nanostructured functional surfaces engineering. Investors are increasingly attentive to intellectual property portfolios, regulatory readiness, and the potential for cross-sector impact. As a result, the field is poised for continued innovation and commercialization, with funding trends reflecting both the technological promise and the practical challenges of bringing advanced surface engineering solutions to market.

Challenges and Barriers: Technical, Commercial, and Regulatory Hurdles

Nanostructured functional surfaces engineering holds immense promise for applications ranging from biomedical devices to energy harvesting. However, the translation of laboratory breakthroughs into commercial products faces significant challenges across technical, commercial, and regulatory domains.

Technical Hurdles: The fabrication of nanostructured surfaces with precise control over morphology, uniformity, and reproducibility remains a major obstacle. Techniques such as electron beam lithography, nanoimprint lithography, and self-assembly offer high resolution but are often limited by scalability and cost. Achieving consistent performance over large areas, especially for applications like anti-fouling coatings or optical devices, is difficult due to defects and variability in nanostructure formation. Additionally, the long-term stability and durability of these surfaces under real-world conditions—exposure to mechanical stress, temperature fluctuations, or chemical environments—are not always well understood, necessitating further research and robust testing protocols.

Commercial Barriers: The high cost of advanced nanofabrication equipment and materials can hinder the economic viability of nanostructured surface products. Scaling up from prototype to mass production often requires significant capital investment and process optimization. Furthermore, integrating nanostructured surfaces into existing manufacturing lines may demand new equipment or modifications, increasing operational complexity. Market acceptance is another challenge, as end-users may be hesitant to adopt new technologies without clear evidence of superior performance, reliability, and cost-effectiveness compared to established solutions. Companies such as BASF SE and DSM Coating Resins are actively exploring scalable solutions, but widespread adoption remains gradual.

Regulatory Hurdles: Regulatory frameworks for nanomaterials and nanostructured products are still evolving. Agencies like the U.S. Environmental Protection Agency (EPA) and the European Commission Directorate-General for Environment are developing guidelines for the safe use, labeling, and disposal of nanomaterials. However, the lack of standardized testing methods and long-term safety data complicates regulatory approval processes. Manufacturers must navigate a complex landscape of national and international regulations, which can delay product launches and increase compliance costs. Ongoing collaboration between industry, regulatory bodies, and research institutions is essential to address these uncertainties and facilitate responsible innovation in nanostructured functional surfaces engineering.

Future Outlook: Emerging Opportunities and Disruptive Technologies (2025–2030)

The future of nanostructured functional surfaces engineering between 2025 and 2030 is poised for significant transformation, driven by emerging opportunities and disruptive technologies. As industries increasingly demand materials with tailored surface properties—such as superhydrophobicity, antimicrobial activity, and enhanced optical or electronic performance—nanostructured surfaces are expected to play a pivotal role in next-generation products across sectors including healthcare, energy, and electronics.

One of the most promising opportunities lies in the integration of nanostructured surfaces into medical devices and implants. Advanced surface engineering can impart antibacterial and antifouling properties, reducing infection rates and improving patient outcomes. Organizations such as Baxter International Inc. and Medtronic plc are actively exploring these innovations to enhance the safety and longevity of their products.

In the energy sector, nanostructured coatings are expected to revolutionize solar panel efficiency and durability. By manipulating surface textures at the nanoscale, manufacturers can minimize reflection and maximize light absorption, leading to higher energy yields. Companies like First Solar, Inc. are investing in research to commercialize such advanced coatings, aiming to make renewable energy more cost-effective and reliable.

Electronics and semiconductor industries are also set to benefit from disruptive advances in nanostructured surfaces. The development of ultra-thin, self-cleaning, and anti-reflective coatings can enhance device performance and longevity. Intel Corporation and Samsung Electronics Co., Ltd. are among the leaders exploring these technologies for next-generation displays and sensors.

Looking ahead, the convergence of artificial intelligence (AI) and machine learning with nanostructured surface design is expected to accelerate innovation. AI-driven modeling can optimize surface architectures for specific functions, reducing development time and cost. Furthermore, scalable manufacturing techniques such as roll-to-roll nanoimprinting and atomic layer deposition are anticipated to enable mass production, making advanced nanostructured surfaces accessible for widespread commercial use.

Overall, the period from 2025 to 2030 will likely witness nanostructured functional surfaces transitioning from niche applications to mainstream adoption, catalyzed by cross-disciplinary collaboration and rapid technological progress.

Strategic Recommendations for Stakeholders

Strategic recommendations for stakeholders in the field of nanostructured functional surfaces engineering are essential to harness the full potential of this rapidly evolving discipline. As the integration of nanostructured surfaces into commercial products accelerates, stakeholders—including manufacturers, research institutions, regulatory bodies, and end-users—must adopt coordinated strategies to ensure sustainable growth, innovation, and market competitiveness.

- Foster Cross-Sector Collaboration: Stakeholders should prioritize partnerships between academia, industry, and government agencies to accelerate the translation of research into scalable applications. Collaborative platforms, such as those promoted by the National Institute of Standards and Technology, can facilitate knowledge exchange and standardization efforts.

- Invest in Advanced Manufacturing: To achieve cost-effective and reproducible nanostructured surfaces, investment in advanced manufacturing technologies—such as roll-to-roll nanoimprinting and atomic layer deposition—is crucial. Companies like Oxford Instruments are leading in providing enabling equipment and process solutions.

- Prioritize Regulatory Compliance and Safety: As nanostructured surfaces enter sensitive markets (e.g., healthcare, food packaging), stakeholders must proactively address regulatory requirements and safety assessments. Engaging with organizations such as the U.S. Food and Drug Administration and the European Commission ensures alignment with evolving standards and public trust.

- Promote Sustainability and Lifecycle Analysis: Incorporating environmental considerations into the design and production of nanostructured surfaces is increasingly important. Stakeholders should adopt lifecycle analysis frameworks and seek guidance from bodies like the International Organization for Standardization to minimize ecological impact.

- Enhance Workforce Training and Education: The interdisciplinary nature of nanostructured surface engineering demands a skilled workforce. Stakeholders should support educational initiatives and professional development programs, such as those offered by the National Nanotechnology Initiative, to build expertise across materials science, engineering, and regulatory affairs.

By implementing these strategic recommendations, stakeholders can position themselves at the forefront of innovation, ensure regulatory compliance, and contribute to the responsible advancement of nanostructured functional surfaces engineering in 2025 and beyond.

Sources & References

- EV Group

- Oxford Instruments

- International Organization for Standardization (ISO)

- Smith & Nephew plc

- The Boeing Company

- National Institute of Standards and Technology (NIST)

- BASF SE

- Surfix BV

- IBM

- Massachusetts Institute of Technology (MIT)

- Medtronic

- P2i Ltd

- DSM

- Fraunhofer-Gesellschaft

- National Renewable Energy Laboratory (NREL)

- Evonik Industries AG

- European Commission

- European Chemicals Agency (ECHA)

- ASTM International

- National Science Foundation

- Baxter International Inc.

- First Solar, Inc.

- National Nanotechnology Initiative